Medicare Insurance

Medicare Insurance

Baby boomers are rapidly turning sixty-five at a rate of over ten thousand people a day. This massive shift is fostering an immense need for qualified Medicare insurance agents to assist individuals signing up for a Medicare insurance plan. Where you live will determine what Medicare plans are available for you to choose from. ePlatinumHealth -Jean Linos has a local office in Whitewater WI. I service the entire State of Wisconsin (Dane, Green, Jefferson, Rock and Walworth counties) plus Illinois, Indiana, Iowa, Minnesota, Michigan, Georgia, Alabama, and Tennessee.

As your agent and broker, I will work hard on your behalf at no additional cost to you. I represent several Medicare insurance carriers which allow us to custom tailor an option that is most appropriate to your specific needs. I am compensated directly from the Medicare insurance carriers so my services are one hundred percent at no charge to you.

Before you arbitrarily just pick a Medicare plan like choosing straw from a hat, I highly encourage you to call my office. I specialize in Medicare insurance. I have over 10 years of seasoned experience and a strong track record of success, which means happy clients!

Medicare is complicated. Sometimes you’ve enrolled automatically; sometimes you’re not. If you’re not and you miss the enrollment period, you pay a penalty. Some medical services are covered; some are not. If you go to visit your chiropractor, Medicare might pay, but only if it is “manual manipulation of the spine if medically necessary to correct a subluxation." It’s truly a labyrinth. At ePlatinum Health, we make sure you don’t get lost in it.

e-platinum Health – Jean Linos understands it!

It’s my business to comprehend this system with its caveats, exemptions, and exceptions. I will meet with you, listen to your needs, answer your questions, explain your options, and find the most appropriate plan(s) for you to get the coverage that meets your needs and budget. With our help, you won’t be surprised by the lack of coverage or exorbitant out-of-pocket expenses.

Step #1 Enroll in Original Medicare

Medicare Part A covers:

• Hospital, inpatient, and long-term care

• Skilled nursing facility and nursing home care

• Home health services

• Hospice

Medicare is required by federal and state laws to provide coverage for all of the above services, however, they are not required to cover the entire cost. Below, learn more about additional insurance options that can help pay for what Medicare does not.

Medicare Part B: Medical

• “Medically necessary services"

• Medical equipment

• Ambulance services

• Preventative care

• Doctor visits

• Mental health services

• Clinical research studies

As with Medicare Part A, Medicare is required to provide coverage for the above services but is not required to cover the entire cost. Learn more about your additional insurance options below.

Step #2 Decide if you need additional coverage

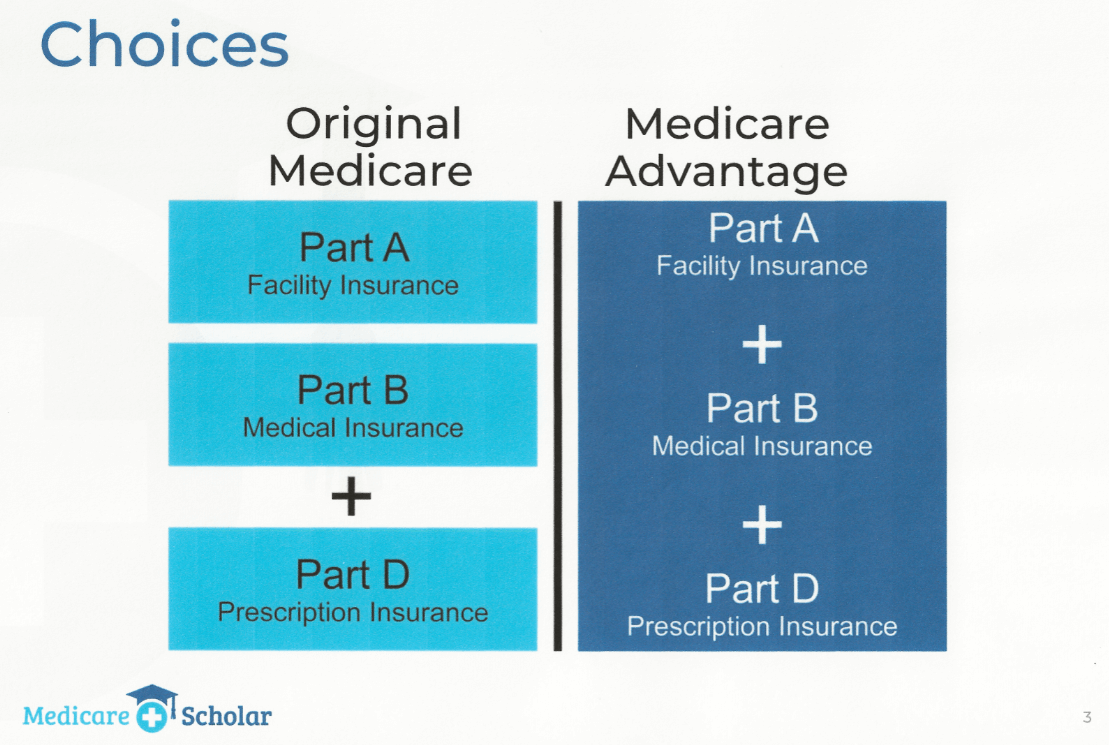

After you have enrolled in Original Medicare (Parts A and B), if you decide you would like additional coverage you have two ways to get it. It is important to understand that with both options below you still have Original Medicare and must continue to pay your Part B premium.

Option #1 – Medicare Supplement Plan

Helps pay some of the out-of-pocket costs that come with Original Medicare, such as hospital stays, doctor visits, and preventative services.

Option #2– Medicare Advantage Plan

Helps pay some of the out-of-pocket costs that come with Original Medicare, such as hospital stays, doctor visits, and preventative services.

AND OR

Medicare Part D Plan – To help pay for prescriptions

Additional Services – Many plans offer services not available on Original Medicare.

Still, confused?

Don’t worry – feel free to give me a call for a comprehensive and free consultation at (262) 264-5445 today 🙂